What policy review will mean

Felex Share Herald Reporter

Felex Share Herald Reporter

Government is moving away from demanding equity in foreign-owned companies exploiting natural resources in the country towards a new model that insists on total control and ownership of all sub-soil assets, experts have said.

The experts said it was time Government redefined the Indigenisation and Economic Empowerment Act to clarify recent changes and turn around the economy by stimulating extraction of mineral resources in partnership with experienced and trustworthy international partners.

Government proposed the Production Sharing Model (PSM) and the Joint Empowerment Investment Model (JEIM) as the two vehicles through which sector-specific implementation of indigenisation would be achieved.

The two vehicles have been successfully applied to oil and gas resources in the Middle East and Latin America.

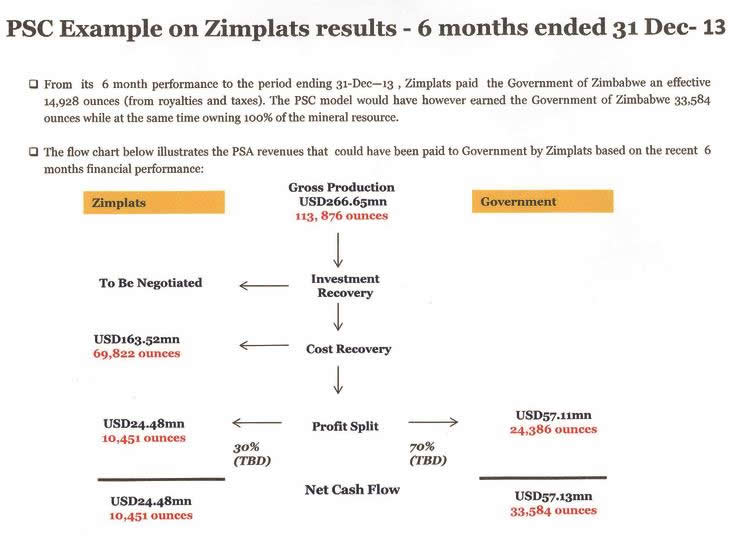

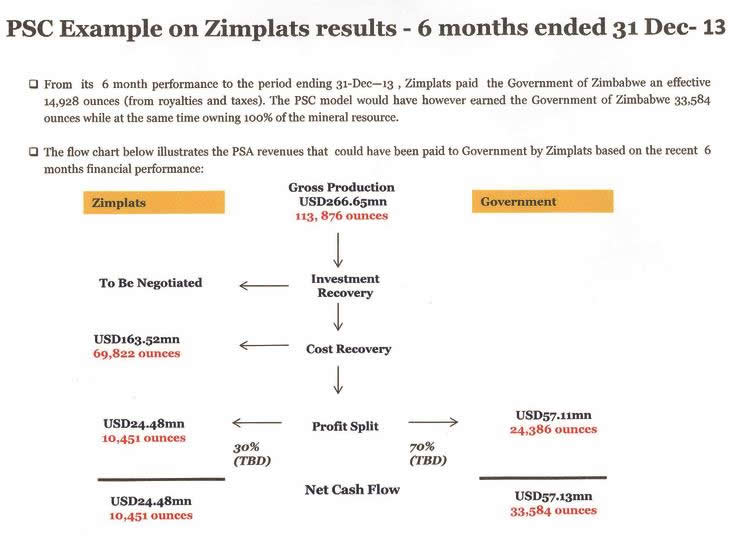

Whereas the Act requires all foreign-owned businesses worth at least US$500 000 to cede 51 percent shareholding to indigenous Zimbabweans, the PSM model allows investors to recover initial capital investment, receive an appropriate return on investment and recoup operational costs.

Under JEIM – outside mining, agriculture and particular tourism investments – indigenous Zimbabweans will be encouraged to enter joint ventures to generate capital to build wholly Zimbabwean-owned enterprises.

A source close to policy development on yesterday said the laws needed to be redefined to capture the changes and provide clarity.

“The existing law demands 51-49 percent disposal for value and it recognises that all sectors should have different thresholds because they have different circumstances,” the source said.

“Sector-specific thresholds can be announced tomorrow because the law accommodates that. It (the law) simply has to be redefined to accommodate the clarifications.”

The source said a highly specific feature of any country’s sub-soil assets was exploration and development of the resources.

He said ventures in this sector were risky as they were expensive and it was difficult to determine in advance the existence and quality of mineral reserves.

He said ventures in this sector were risky as they were expensive and it was difficult to determine in advance the existence and quality of mineral reserves.

“Currently, Government has challenges in accessing the risk capital needed for that and you will realise the challenges emanate from concerns on the indigenisation process and limitation of fiscus in providing such funding,” said the source.

“Production sharing agreements should come into effect with Government awarding the execution of exploration and production activities to a contractor in a specified sub-soil area. The term of contract is typically 20 to 30 years.”

The contractor, the source said, bears all mineral and financial risk and “explores, develops and ultimately extracts minerals from the allocated sub-soil asset.

“The contractor is permitted to use the product from the sub-soil area to recover capital and operational expenditures. The remaining product is split between Government and the contractor at a respective rate,” he said.

He said the key benefits to Government were that no investment capital was needed, 100 percent ownership of the resources and accelerated production of mineral resources at an international level. Employment would also be created due to significant growth in the extractive industry. Added the source: “The share of production to the Government will be paid in resource form and this will form the pillar of Government reserves, which can be monetised as and when Government requires funding whether through sale on international market and or leverage.

“The State will control the duration of exploration and exploitation while to the contractor this clears the path to recovery of investment as well as provides a stable business environment.”

A number of countries with PSA for sub-soil assets include Algeria whose Government share of net production is 55 percent, Angola (51 percent), Cameron (60 percent), Libya (between 81 to 85 percent), Nigeria (maximum of 80 percent) and Equatorial Guinea (60 to 90 percent).

In the DRC, the ratio is negotiated with increase in production, in Gabon ratio varies on amount of production while in Egypt and Tunisia ratio is negotiable.

Former World Bank representative in Zimbabwe Dr Nginya Mungai Lenneiye of Kenya said fine-tuning the indigenisation and empowerment policy would be of great benefit to Zimbabwe.

“The current Act was an equity model whereby Government insisted on earning shares in company, participating in the management of the companies.

“By so doing you face responsibility and liability to the event that when capitalisation is needed you contribute towards that. The objective now is to own the resources not the company. Zimbabwe has the resources and foreign investors have the capital and that is where they have to co-operate on such that they make more money from their capital and you make money from your resources.”

Dr Mungai went on: “And if you make money you can then start your own companies or expand those businesses or put that money in other areas. By so doing you will be unlocking value of what you have.” On Sunday, prominent investment banker and Brainworks Capital Management chief executive Mr George Manyere said the changes would bring clarity to foreign investors.

“This approach was initially announced under the Government of National Unity and sector-specific committees were set up but there has not been official communication of the recommendations and or refinement of the indigenisation law to incorporate the sector-specific recommendations,” he said.

“Lack of clarity had compounded the confusion that investors had on the law negatively affecting FDI flows.”

Mr Manyere added: “Consideration by Government of a production sharing model to complement other instruments being used to empower locals makes sense and not only does it stimulate extraction of sub-soil assets but it also has a significant multiplier effect on the economy, for instance growth in much needed FDI and employment creation.”

Comments