MPs hail Property Bill

Farirai Machivenyika Senior Reporter

Legislators in the National Assembly yesterday welcomed the Movable Property Security Interests Bill, saying the proposed law will ensure access to capital by small businesses and previously financially excluded groups.

Finance and Economic Development Minister Patrick Chinamasa tabled the Bill for its second reading yesterday. The Bill seeks to create a framework within which movable property can be used as collateral in obtaining loans. Contributing to the debate, Chegutu East representative Cde Webster Shamu said the Bill would help fight poverty.

“The Bill clearly defines the best way to fight poverty because the best way to fight poverty is to capacitate the various small businesses we have through access to capital,” he said.

“Small as they are, they require support from all of us.”

Mutasa South representative Cde Irene Zindi said Government should also look at other laws and regulations negatively affecting SMEs.

“I hope we are not going to implement this policy in a vacuum,” she said. “It should be looked at in conjunction with other policies like ease of doing business because business is being affected by so many levies, licences and taxes that end up discouraging people to enter into business.”

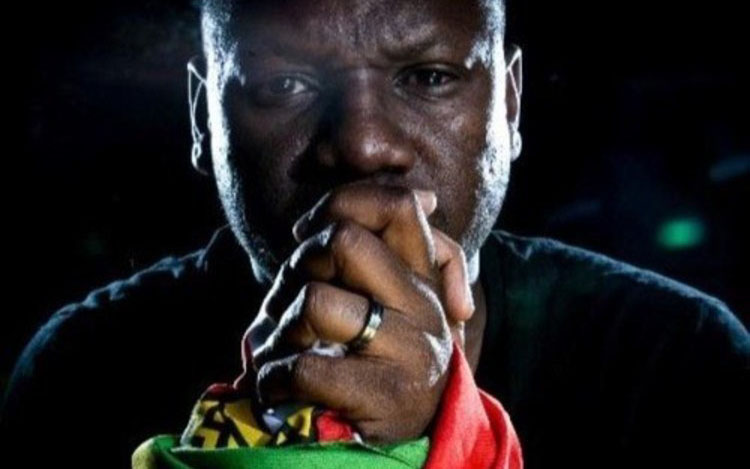

Kuwadzana representative Mr Nelson Chamisa said the Bill would unlock value in property owned by the previously marginalised indigenous Zimbabweans.

“Clearly, once we allow movable property to be monetised we will immediately unlock value in dead capital,” he said. “We will have opened our economy to be an economy for all.

“This will allow us to bank the unbanked, especially those in the rural areas, because they now have valuable assets.”

Responding to the legislators’ contributions, Minister Chinamasa said the Bill was in recognition of the situation prevailing in the country’s economy.

“This is a Bill which is recognising the reality of our situation that our economy is highly informalised,” he said.

Minister Chinamasa said the Bill would allow the informal sector access to credit, which they previously could not access because of lack of collateral. He said micro finance had lent at least $250 million to SMEs and said that figure was expected to grow when the Bill becomes law.

Comments