Metallon Gold strengthens position

Tinanshe Makichi Business Reporter

Metallon Gold Corporation expects to produce about 500 000 ounces per annum in the next five years as the mining group steps up efforts to strengthen its position as the largest gold producer in the country.

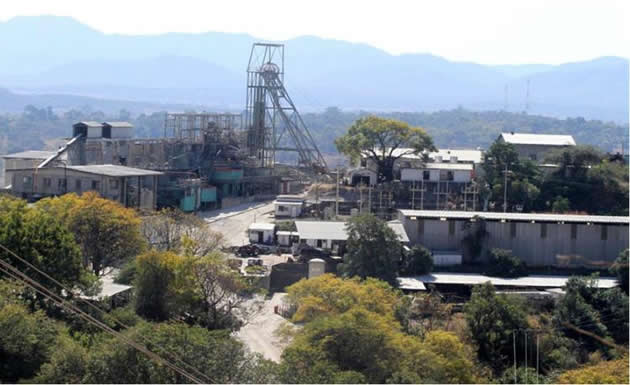

Metallon Gold is owned by South African mining magnate Mr Mzi Khumalo and has five gold mines in Zimbabwe which are How Mine, Shamva Mine, Arcturas Mine, Mazowe Mine and Redwing Mine.

Metallon also owns Motapa mine north of How Mine and Midwinter between Kadoma and Chegutu.

The mining giant is expecting to produce 100 000 ounces this year against the 2013 production of 82 000 ounces.

Metallon Gold chief executive designate Mr Kenneth Mekani said some of their operations are not running at full capacity so there are plans to ramp up the operations and expansion.

“Our plan basically is centred on the fact that in the next five years Metallon should produce at least 500 000 ounces per year.

“We have an ambitious expansion plan and we know that we cannot achieve our plans if we do not a good relationship with the authorities of Zimbabwe,” said Mr Mekani.

“Wherever possible we are going to engage in mergers and acquisitions if an opportunity fits our strategic vision.”

Metallon currently sits on a resource of 8 million ounces and after a review the figure now sits at 9,6 million and that has been signed off by SRK .

Mr Mekani said the group is sitting on a resource where even if they mine at 1 million ounces Metallon can still mine for the next 8 years minimum.

How mine which is Metallon’s flagship mining unit is forecasting a production target of approximately 52 000 ounces this year against 40 300 ounces for last year.

How mine produces 55 percent of the group’s output and 15 percent of the country’s total output.

He said even if gold prices continue to fall How Mine will continue to survive. Shamva, Mazowe and Arcturus right now are contributing about 45 percent of the company’s output.

Mr Mekani said Redwing mine in Penhalonga is under some development and they hope it will be operational by the mid next year.

“Metallon has great potential in the properties within its portfolio and it is our aim to open up the operations so that we can continue to contribute to the Zimbabwe economy.

“Most of our operations are shallow if you compare with South Africa where some of the operations are 4 000 metres for us on average our operations are just about 1 000 metres,” said Mr Mekani.

He said Metallon is a low cost gold producer and currently an average for the group sits at $900 per ounce while there is an opportunity to even reduce the costs further to $800.

“The other advantage is that we are sitting on a resource of 8 million ounces minimum which means we have the potential to expand .We have some plans to embark on some expansion projects especially at Shamva, How mine and Mazowe mine,” said Mr Mekani.

At Mazowe mine, Metallon plans to embark on some sand re-treatment project and the exercise has already started with a hope to start retreating the sands by May next year.

“On the expansion at Mazowe, we are working closely with Environmental Management Agency so that we make sure we are in line with environment safety issues.

“Last year we produced an output of 82 000 ounces and for this year we are going to produce about 100 000 ounces and I am happy to say that the half year results that we achieved show that we are on course to produce the targeted 100 000 ounces for this year,” he said.

Comments