Increased price flexibility on Zim market

Business Reporters

MANUFACTURERS have started packing products in smaller quantities to push volumes and in response to improved availability of small change following introduction of bond coins. This comes as supermarkets and other retailers have also started applying the real exchange rates when accounting for transactions involving the South African Rand and the dollar.

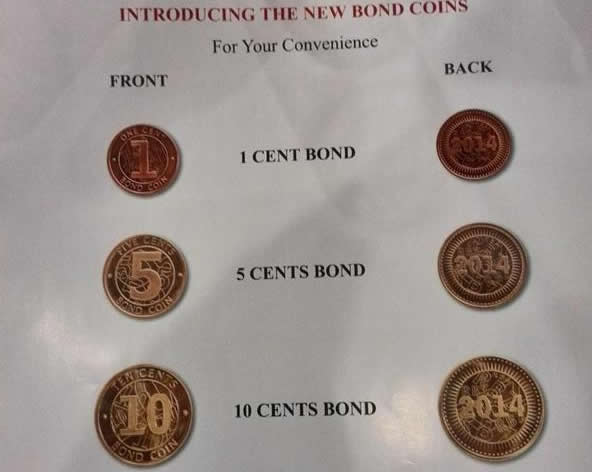

Improved availability of small change and divisibility of the major currency, dollar, follows introduction of 1c, 5c, 10c and 25c dollar equivalent bond coins backed by a $50 million bond.

Reserve Bank of Zimbabwe Governor Dr John Mangudya unveiled the bond coins in December last year and yesterday said 50c denominations will come into circulation by next week.

A snap survey carried by The Herald Business yesterday revealed that a number of retailers were stocked with a gradually increasing number of products in much smaller packs at lower prices.

Although virtually all prices were pegged from a round figure of $1 dollar prior to introduction of bond coins, there was no deliberate effort to increase or introduce smaller units for lower values.

Confederation of Zimbabwe Industries president Mr Charles Msipa said while it was not a industry practice to discuss pricing, availability of change promoted trend towards lower prices.

“When we come together as industry we discuss common environment issues and policy, we do not discuss business strategy, and individual businesses determine prices that suit their category.

“But in the current environment of depressed demand, consumer goods can increase sales if the company can demonstrate and can provide products that are low priced,” Mr Msipa said.

“Small change makes a huge difference because retailers were selling items bundled together, say for a dollar, when they believed that a single item for instance cost 30c,” he said.

Mr Msipa said that improved change availability would definitely facilitate the trend towards pricing below a dollar.

“That can support the trend towards that lower price point,” Mr Msipa said.

Consumer Council of Zimbabwe executive director Ms Rosemary Siyachitema said firms were now packaging products in smaller quantities because of liquidity challenges in the country.

“It means consumers have less money in their pockets and cannot afford to buy big quantities. For manufacturers, it would be ideal to package smaller quantities afforded by consumers.”

It was rare to find single products, even small items, priced as low as 15 cents for instance, as prices rounded to $1 and where this want not the case, consumers were forced to take unwanted items.

But if what has started reflecting on supermarket shelves is anything to go buy, manufacturers could be the latest to join the wave of price and volume adjustment in the country.

This will bring about a situation where Zimbabweans place or respect the real value of the dollar, the dominant but scarce transaction currency, which until recently was grossly abused.

Prices of Delta Corporation, the biggest beverage maker in Zimbabwe, soft drinks now range from $50 cents or 60 cents for 330ml bottles to $2,25 for a 2 litre bottle across the brands. Delta’s other soft drink pack sizes include the 1 litre bottles ($1,40), 500ml (95c) and 350ml (60c).

Milk processor, Dendairy, has packet sizes ranging that include 1 litre priced at $1,29, 500ml (0,69c), 200ml (0,30c), and 100ml (0,15c), which indicated increased pricing flexibility. National Foods also has smaller units priced according to the small quantities and these include the 500g of flour retailing $1,31 and this ranges to $5,59 for larger packs such as 5kg packs.

The pricing flexibility has allowed multiple pricing levels for common products such as the Ingram’s Camphor Cream, which retail from 75c (75g), $1,30 150g, $1,50 (300g) and $1,85 (500ml).

The pricing trend shows an inclination towards proper pricing models that take cognizance of better divisibility of the main transaction currency and need to cater for different classes of consumers.

Higher pricing, which did not factor in the strength of the greenback, made Zimbabwe an expensive economy, resulting in constant demands for unsustainable high wages and salaries.

Comments