Income Tax Bill submitted to President

Business Reporter

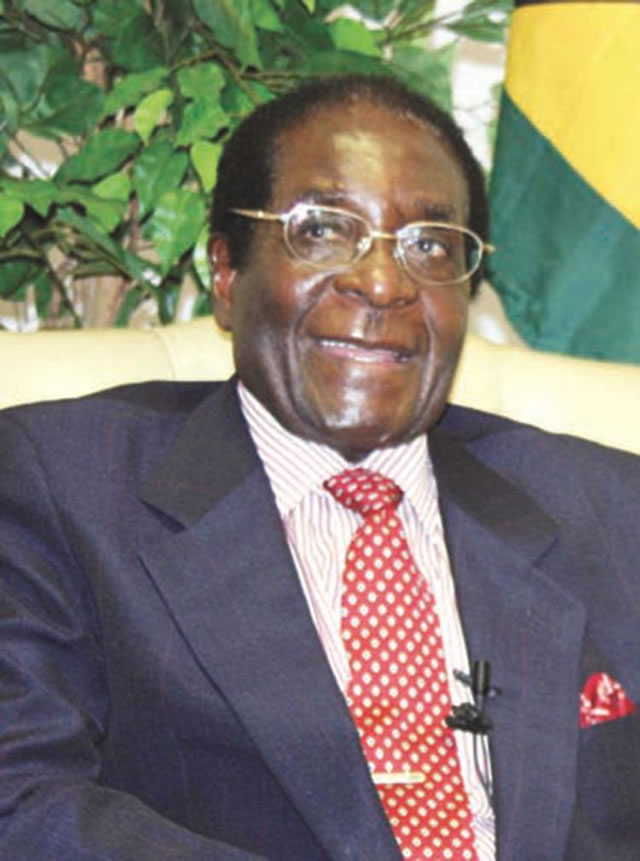

THE new Income Tax Bill, which seeks to broaden the tax base, repeal and replace the Income Tax Act and Capital Gains Tax Act, has been submitted to President Mugabe for his assent. According to the Government Gazette published on Friday, the Bill was sent to President Mugabe by Clerk of Parliament Austin Zvoma on November 8.

“It is hereby notified, in terms of Section 131 (5) of the Constitution of Zimbabwe that the Speaker of the National Assembly has, on 8th

November, 2013, sent the Income Tax Act to his Excellency the President of Zimbabwe for his assent,” he said.

The Bill proposes a major shift from a source-based tax system to a residence-based tax system.

If it becomes law, Zimbabwean residents will be subject to tax on income and gains from anywhere in the world subject to an offset of the foreign tax paid.

Temporary residents would generally be liable to pay Zimbabwean tax on their worldwide income which is required to be remitted to Zimbabwe in terms of the Exchange Control Regulations and all income derived from a source in Zimbabwe.

The Bill also provides that tax deductible expenses can only be those closely related to the production of the income in question.

During consultations held across the country earlier this year, the Bill was criticised as stakeholders raised concerns that while reforms were mainly expected to increase inflows into Government coffers, flaws in the proposed law could actually result in many taxpayers evading tax obligations.

There were concerns that the public would be taxed on virtually every earning they got, including gifts.

The Bill also proposed to tax those in the Diaspora.

Then Finance Minister Tendai Biti later made several concessions to the amendment of the Bill after a Parliamentary Committee on Budget, Finance and Investment Promotion also raised reservations on it.

One of the amendments raised was Clause 26 that sought to levy taxes on Diaspora funds which the committee felt would lead to drying up of such funds coming to Zimbabwe.

Mr Biti also consented to amendment of the clause on penalties where the Bill sought to impose 100 percent penalty on non-compliant individuals and corporate.

Another clause he consented to related to the US$10 000 as the maximum deduction allowed on motor vehicles which stakeholders felt that the amount was too low hence it encouraged people either to buy second-hand vehicles or those that were unsafe since good ones hovered around US$25 000.

On the residence-based system, Mr Biti conceded to give an amnesty on taxpayers on condition that they make full disclosures of foreign assets and pay an appropriate figure to be decided.

He agreed to include a provision on the interpretation clause that a court was bound by the law of precedence in interpreting the tax law to allay fears from stakeholders.

Some of the provisions he declined to concede to related to submission that employees from the private sector should not have their housing and transport allowances taxed as just like civil servants.

The other aspect was on Capital Gains Tax after Mr Biti allayed fears that arose from the committee that the Bill seemed to assume that the entire proceeds of such assets were taxable without any deductions.

Comments