‘Improve credit rating’

Tinashe Makichi Business Reporter

Tinashe Makichi Business Reporter

The International Monetary Fund says Zimbabwe should improve its credit rating level in order to raise the $27 billion required for the implementation of the Zimbabwe Agenda for Sustainable Socio-Economic Transformation economic blueprint.Projects and programmes under the country’s new economic blueprint require over $27 billion and of the amount, domestic financial resources are estimated at $2 billion, representing about 7,5 percent, leaving over 90 percent of the financing to external funding.

Speaking before the Parliamentary Portfolio Committee on Budget and Finance yesterday, IMF resident representative Mr Christian Beddies said there should be a continued satisfactory implementation of the staff monitored programme to build a track record for the country before international financiers.

“Efforts should be accelerated to improve the country’s credit rating in order to attract the required foreign direct investment for Zim-Asset to be a success.

“The debt issue should be addressed first for the country to get the required funding for developmental projects enshrined within the economic blue print.

“IMF under SMP in conjunction with authorities is committed to the improvement of Zimbabwe’s credit rating because the current rating has made it difficult for the country to secure sustainable long-term funding,” said Mr Beddies.

In bid to make the ZimAsset a success Government is also exploring a possibility of financial assistance through regional bilateral arrangements with Botswana, Angola and South Africa.

Government is also looking into the possibility of tapping into the 29,1 billion fund set aside for the Caribbean and Pacific countries under the 11th European Development Fund as well as how to benefit from Islamic Bonds which have over $110 billion in reserves.

Zimbabwe’s arrears with multilateral finance institutions such as the World Bank and IMF stand at over $6 billion, making it an unattractive candidate for fresh funding.

Mr Beddies said successful implementation of the SMP is key to reducing the debt.

“IMF does not do credit rating; our role currently is to provide technical assistance to authorities so that the country becomes more attractive for investment.”

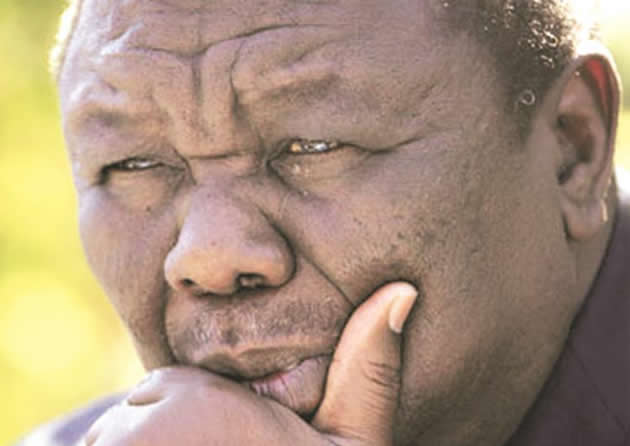

Former Finance Minister and Member of Parliament Dr Chris Kuruneri said a resolution to the country’s debt issue should be addressed immediately although some of the solutions to the country’s problems are beyond borrowing from international financial institutions.

“Zimbabwe is capable of paying its own arrears and it calls for a dedicated approach from authorities to come out with an amicable resolution to the debt issue,” said Dr Kuruneri.

Comments