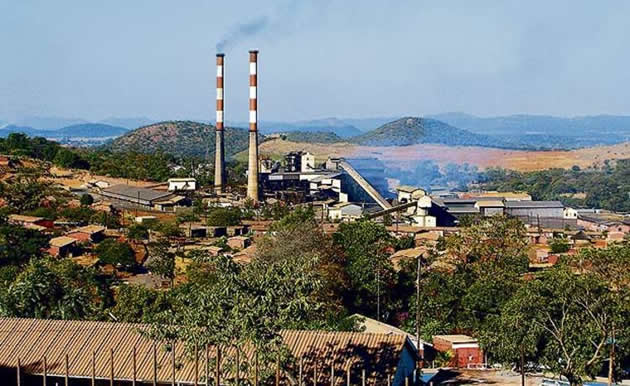

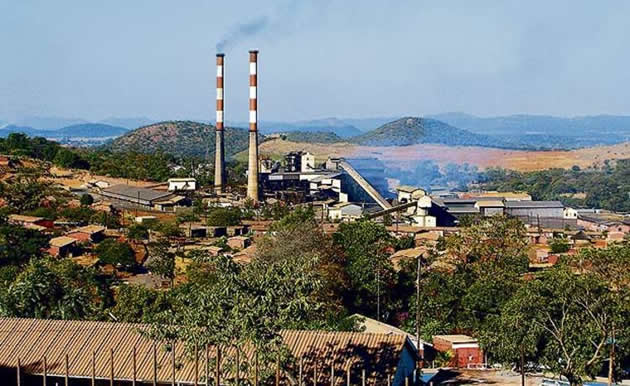

Global commodity prices constrain Mwana Africa

Mwana Africa operations in the first quarter to June 2016 were constrained due to falling commodity prices on the global market

Business Reporter

Mwana Africa’s operations in the first quarter to June 2016 were constrained due to falling commodity prices on the global market coupled by production interruptions as the group carried out plant equipment upgrade.

Production of nickel in concentrate at the group’s nickel mining arm, Bindura Nickel Corporation went down 34 percent to 1,349 tonnes compared to 2,032 tonnes in the fourth quarter FY2015 primarily due to a reduction in average head grade and recoveries.

Head grade at BNC was 26 percent lower at 1,2 percent compared to 1,67 percent in Q4 FY2015 due lower production of massive ores areas compared to the previous quarter

The average net realised nickel in concentrate price dropped by 11 percent to $8,461 per tonne compared to $9,489 per tonne in Q4 FY2015.

Nickel sales during the period were 39 percent lower at 1,267 tonnes compared to 2,072 tonnes in Q4 FY2015 due to lower production.

At Freda Rebecca, tonnes milled slightly decreased 0,3 percent to 293,759t in Q1 FY2016 compared to 297,953t in Q4 FY2015, due to a one percent decrease in mill running time.

The average feed grade for Q1 FY2016 increased 11 percent from 1,81 grammes per tonne in Q4 FY2015 to 2,03 grammes per tonne.

Gold recovery rate for Q1 FY2016 declined one percent to 82 percent from 83 percent in Q4 FY2015.

16,985 ounces of gold were produced in Q1 FY2016 against 13,443oz in Q4 FY2015 and the production increase was mainly attributable to the 11 percent increase in the mill’s average feed grade.

Cash costs for the period were 25 percent lower at $930 per ounce from $1,234 per ounce in Q4 FY2015 because of an increase in ounces produced and a five percent reduction in operating costs.

The average gold price received in Q1 FY2016 was three percent lower at $1,186 per ounce compared to $1,223 per ounce in Q4 FY2015.

Klipspringer’s throughput of Marsfontein fine residue tailings fell to 38,760 tonnes which was 10 percent lower than in Q4 FY2015

Head grade improved by eight percent to 44 carats per hundred tonnes. Mining continued through a transition zone so as to access higher grade material

Diamond sales for the period fell 45 percent quarter on quarter and the price received for fine diamonds produced by the mine fell seven percent quarter on quarter.

Mwana Africa said this was in line with market conditions, which are expected to remain constrained.

Mwana Africa executive chairman Mr Yat Hoi Ning said the quarter has not been without its challenges but they have since been addressed progressively.

“Our main challenges have been external, particularly those of falling commodity prices. However, I remain confident that we can manage and counter the effects of lower prices by operating effectively and economically,” said Mr Hoi Ning.

“At Freda Rebecca the average gold price received was $1,186 per ounce, it’s lowest in several quarters. But we countered the adverse effect by producing more gold which, in turn, contributed to a significantly lower cash cost of $930 per ounce and an all in sustaining cost of $1,093 per ounce. This means the mine remains operationally profitable and will be maintained in that state,” he said.

He said operations continued to be hampered by the continued upgrading of equipment at BNC.

Mr Hoi Ming said upgrading will ensure there are fewer interruptions in future.

“Underground development work has proceeded more slowly than had been planned, but with the redeep project now scheduled for completion in October 2015, the current financial year’s second half should see considerable operating improvements that will be followed by the benefits of the smelter restart,” he said.

Mr Hoi Ming said work on the restart is proceeding on schedule and, when completed, will result in our receiving enhanced prices for the nickel contained in our products.

He said during the quarter underground operations were affected by temporary poor availability of ore draw points which resulted in lower utilisation of equipment and increases in underground transport equipment.

“The result was slower mining rates, though these should improve sharply during the current quarter.

“Overall costs were tightly controlled in the quarter under review, and this will continue well into the future,” said Mr Hoi Ming.

He said is not yet clear when commodity prices will improve from their currently depressed levels, but the group’s operations remain cash flow positive.

Comments