DPC hopes against hope

Africa Moyo Business Reporter

Debt collection and disposal of AfrAsia Bank Zimbabwe Limited’s assets is still underway as the liquidator battles to raise funds to pay depositors due to an illiquid market. The development comes at a time when a paltry $4,8 million has been paid out of claims of $61 million that were provisionally accepted by the Master of the High Court after three creditors meetings held between 2015 and last year.

AfrAsia Bank — formerly Kingdom Bank — had its operating licence withdrawn by the Reserve Bank of Zimbabwe (RBZ) in February 2015 after realising it became clear that it was in a financial mess. Of the $4,8 million paid out so far; $2,95 million was paid in two dividend tranches, while $1,9 million was paid from the Deposit Protection Fund (DPF).

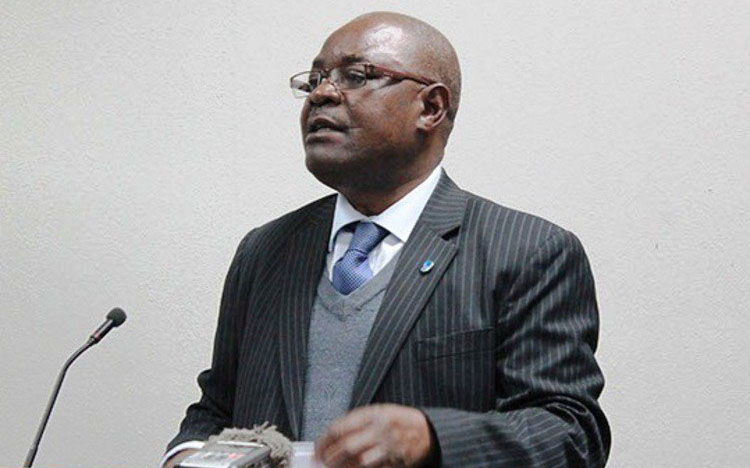

Under the DPF, the Deposit Protection Corporation (DPC) pays $1 000 to depositors whose banks have closed. DPC chief executive officer Mr John Chikura, told The Herald Business yesterday that the total dividend to be paid to depositors would be ascertained “once we have prepared the third interim liquidation and distribution account”.

However, Mr Chikura conceded that debt collection and disposal of assets “is still ongoing”. At the moment, payouts remain constricted due to the court battles involving the DPC and some AfrAsia debtors.

“Court challenges relate to various debtors who have been taken to the courts for non-payment of their outstanding obligations. The cases are at various stages of litigation — some are at the pre-trial conference stage, some are awaiting trial dates and on others, the bank has obtained judgments and summons have been issued whilst others are at the execution stage. Due to bank-client confidentiality, we cannot disclose the names of the debtors under litigation,” said Mr Chikura.

Beyond the court cases, the AfrAsia liquidator is also battling to generate funds to pay depositors due to lack of money on the market. DPC had hoped to pay another dividend during the second half of this year, but failed because of “the illiquid market” and court cases that continue to impede the anticipated timing of the liquidation distributions. Mr Chikura said they are working on transactions, which upon conclusion, could see a dividend of between 10 and 15 cents per dollar being paid out.

It is now expected that the third interim dividend would be paid in the first quarter of next year to concurrent or unsecured creditors, after all preferred creditors have been paid. Preferred or secured creditors such as the National Social Security Authority (NSSA), Zimdef and the Zimbabwe Revenue Authority are understood to have been paid.

Secured creditors are those that have an interest in property that allows a creditor to have your property sold to satisfy debt to that creditor. Mortgage lenders, for instance, are classified as secured creditors. AfrAsia Bank was founded as Kingdom Financial Holdings in 1994, but crumbled due to high non-performing loans.

The bank reported high levels of NPLs, which shot up from 13 percent in 2012 to 82 percent in 2015, resulting in severe liquidity challenges. Stung by the delays in concluding the AfrAsia transactions, some depositors are raising concern that the liquidators drag their feet so that they make more money.

However, Mr Chikura said the payment of liquidator fees is prescribed by provisions of the Companies Act (Chapter 24:03) as read with the Estate Administrators (Amendment) Rules, 2017 (No.3).

“In other words, a prescribed rate is applied to gross collections and the time frame of the liquidation has no bearing on the amount the Liquidator will be paid. If the entity under liquidation has a low asset base and low recovery rate, it does not follow that because extending the liquidation process indefinitely will also lead to an increase in income. If anything, an unjustified extension is likely to be costly to the liquidator,” said Mr Chikura.

Comments