Deflation or price correction?

Business Reporters

Business Reporters

Zimbabwe’s annual inflation maintained a downward spiral shedding a further minus 0,42 percentage points in February to minus 0,91 percent in March as liquidity and diminishing aggregate demand provided little latitude for increase in prices. According to figures from the Zimbabwe National Statistical Agency, the annual rate of inflation fell by an average minus 0,91 percent between March 2013 and March 2014.

“The year-on-year inflation rate for the month of March 2014, as measured by the all items consumer index stood at minus 0,91 percent, shedding 0,42 percentage points on the February 2014 rate of minus 0,49 percent,” Zimstat said.

Economic analysts warned yesterday that due to tightening liquidity conditions and continued decline of aggregate demand, companies cannot increase prices of goods; instead, they have had to cut prices even where costs are rising.

Harare economist Mr Best Doroh said companies could sustain price cuts for a certain period, sacrificing profits and viability in the long run, with the grim prospect that constrained viability could lead to a scale down and closure.

“It is an indication of falling prices due to liquidity problems and aggregate demand, which is necessary for pushing up prices. If that continues, companies cannot pass on costs to consumers, which might lead to a situation where they would have to scale down,” he said.

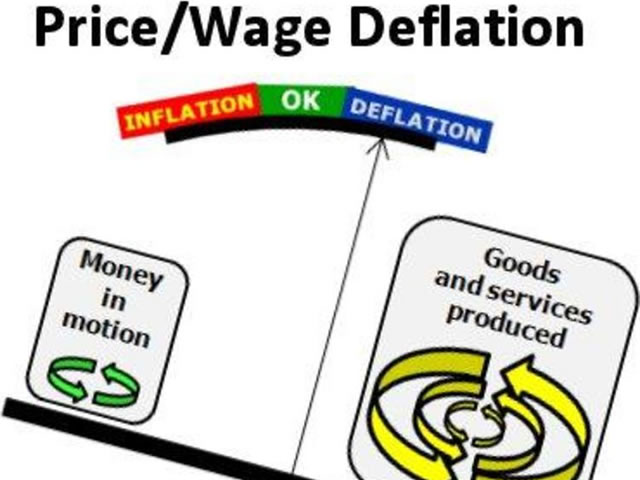

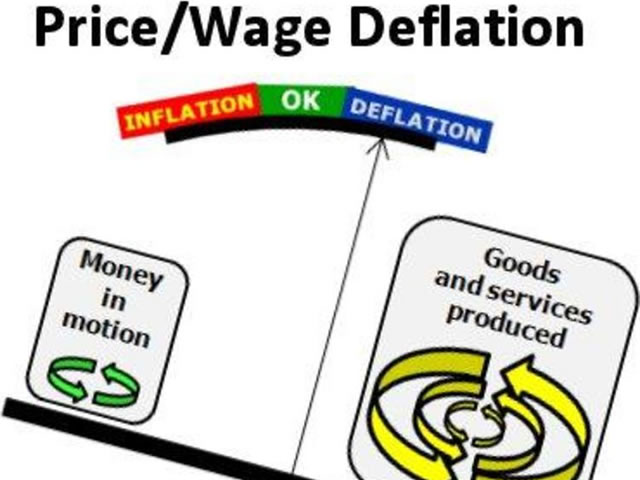

Economists warned deflation is harder to get out of as it includes various stimulant packages which have to boost aggregate demand .

Inflation on the other hand only calls for Government to stop printing money.

Year-on-year food and non-beverages inflation prone to transitory shocks stood at minus 3,71 percent while non-food inflation was 0,51 percent. Monthly inflation for March 2014 was minus 0,22 percent, shedding 0,27 percent in February.

At the moment, consumer disposable income is rapidly decreasing and there seems to be no measures on the plate to turn this pattern around. In fact, companies are on a downscale as they face difficulties in continuing operations at their previous capacities. The unfortunate ones have succumbed to the economic pressures and stopped operating altogether. This has fuelled unemployment and made consumers even worse off.

Economist Mr Witness Chinyama said that Zimbabwe is going through price self correction because there are people importing from regional economies offering lower prices.

“As long as one can go to South Africa and buy at lower prices, imports will continue and this will continue to dampen prices. As long as there are price differentials prices will keep falling. There is price equalisation going on in the region. While prices are falling in Zimbabwe they could still be higher compared to the region due to a combination of factors,” he said.

Mr Chinyama added that Zimbabwe is a high cost producer due to issues that include tight liquidity and other hardships; hence imports are more attractive than local goods. Zimbabwe finds itself in suffocating liquidity after dollarisation, which meant transition to the use of foreign currency. The country does not print currency at the moment.

Having scrapped its own currency at the height of hyperinflation, which peaked at 231 million percent at the last official count before introduction of the multi currency system in 2009; the country cannot do much to influence liquidity in the economy.

This is because export performance, diaspora inflows remain subdued; lines of credit and foreign direct investment have also trickled in insignificantly due to perceived country risk.

Local industry is trapped in suffocating liquidity crunch that has made it difficult to raise funds for recapitalisation to improve efficiency and enhance competitiveness, deprived firms of working to increase production in what has spawned viability challenges.

Options available to Government include re-engaging multi and bi-lateral lenders, negotiated settlement to the issue of illegal sanctions, optimising revenue from minerals, resolving the debt issue, tapping into the informal sector for revenues and making Zimbabwe more attractive to investors.

In a situation where viability is compromised, companies have struggled to pay living wages and salaries while in extreme cases companies have either laid off or closed shop. Last year, the National Social Security Authority said 711 firms closed shop in Harare since 2011, rendering 8 336 people jobless.

Early this year, Zimbabwe Congress of Trade Unions said 9 617 jobs were lost and 75 firms closed last year amid fears the trend could escalate this year as the economy shrinks.

The majority of retrenched people have turned to different forms of informal activities to eke out a living, but even then liquidity remains an issue as their products have to find buyers. The twin problems of tight liquidity and low aggregate demand have “conspired” to bear the deflation down spiral as businesses battle to remain afloat, holding out for a change of fortunes.

A myriad of issues, ranging from inconsistent power supply to cost of labour, shortage of raw materials, cost of utilities, inflexible labour laws, external competition and production costs top the list of problems troubling companies.

However, elusive and expensive cost of funds remains the single biggest threat to the survival of local companies, which had seen industrial capacity improving to 57 percent in 2011 from about 10 percent in 2008, slumping once again.

According to the Confederation of Zimbabwe Industries 2013 manufacturing sector survey, industrial capacity utilization fell from an average 44,6 percent in 2012 to 39,6 percent last year due to afore mentioned economic factors.

Analyst said many of the large industry of yester-year may not go back to the old glory days while access to funding would remain an issue to the smaller and more adaptive entities that could replace them. Even the informal enterprises that now account for the bulk of employment in Zimbabwe need affordable long term funding to support their activities no less reorganisation and more skills training and orientation in proper financial management to make their operations sustainable.

Comments