Defining moment for Zim’s MSME sector

A study carried out by FinScope in 2012 shows that 5,7 million people work in the MSME sector in Zimbabwe

Dr Gift Mugano

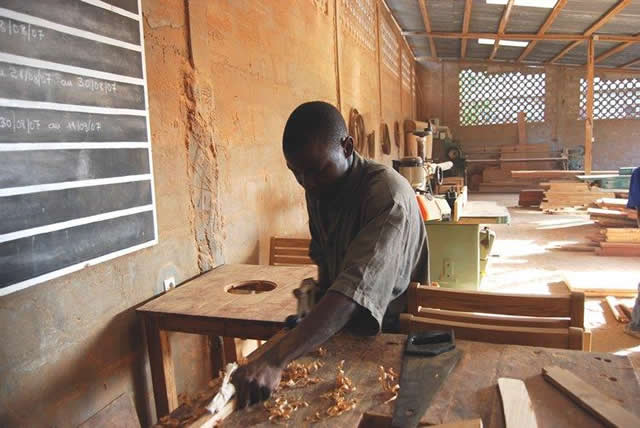

The Ministry of Small and Medium Enterprise and Cooperative Development is undertaking the development of a formalisation strategy for the informal sector. This is a defining moment in Zimbabwe’s history. In order to rally all stakeholders in this process, this week’s discussion focuses on the business case of formalisation.Overview of the Micro Small and Medium Enterprises (MSMEs)

A study carried out by FinScope in 2012 shows that 5,7 million people work in the micro small and medium enterprises (MSME) sector in Zimbabwe, including 2,8 million MSME owners (18 years and older) and about 2,9 million employees (any age).

Only 22 percent of employees work full-time. Although paid employees are mainly male, unpaid workers are mainly female (many of them are spouses working in the business). The MSME owners are usually middle aged (73 percent are over the age of 30).

Basic demographics such as gender and location broadly reflect the distribution of the total adult population. As such, 53 percent of MSME owners are female (mainly individual entrepreneurs engaged in agricultural activities), and 66 percent of MSME owners are located in rural areas.

MSME owners generally have good levels of education (71 percent some secondary education or more), and are usually heads of households (65 percent).

Often, income from entrepreneurial activity is supplemented by other sources of income such as another business or salaried job.

The main motivation to start the business is driven by need, meaning the businesses are survivalist rather than opportunity based.

Although business owners have largely positive attitudes towards the business, many are worried about sustainability.

MSME owners usually work long hours but have low levels of income.

The 2,8 million MSME owners own an estimated 3,5 million businesses (meaning, some business owners have more than one business).

They are mainly individual entrepreneurs without any employees (about 71 percent) and micro-businesses with 1 to 5 employees (24 percent).

The sector is driven by agricultural activities (43 percent), wholesale and retail (33 percent).

Most of the businesses are located in the rural areas (66 percent), and operate mainly from residential premises (39 percent) and farms (22 percent). They are largely informal (85 percent are not registered or licensed) and relatively young (40 percent are in the start-up and 31 percent are in the growth phase; in total 71 percent have been in operation for 5 years or less).

The term “informal businesses” refers to enterprises that are not registered and/or licensed with any Government institution within Zimbabwe.

Uncertainties, the scale of business activities, as well as the costs and complexities of registration affect the motivation to formalise the business.

About 57 percent of MSME owners are financially included.

That means they use/have financial products/services to manage their business finances, ie using formal and/or informal product/services, including savings, borrowing, and/or insurance, excluding those who save at home and those who borrow from family and friends.

This means that 43 percent of MSME owners are financially excluded, ie they do not use any financial products/services, neither formal nor informal, to manage their business finances; however, they might borrow from family and friends, and/or save at home.

Only 18 percent are served by formal institutions, including products/services from commercial banks and other formal non-bank institutions. Informal financial mechanisms (eg savings groups) push out the boundaries of financial inclusion as every second MSME owner uses informal mechanisms to manage their business finances. 72 percent of MSME owners save, mainly at home.

Only 15 percent borrow money, mainly from family and friends. Main drivers for savings and borrowing relate to growing/expanding the business.

Main barriers, in turn, relate to monetary reasons (low/irregular income). Although MSME owners face a number of risks, most are not insured (80 percent).

Financial inclusion is higher among small and medium size businesses, women (mainly through the use of informal mechanisms, ie their involvement in savings groups etc), registered/licensed businesses, and in urban areas and main urban centres (Bulawayo and Harare).

Main challenges reported by MSME owners relate to access to finance/sourcing money, lack of raw material and operational space/working facilities.

The following challenges affect financial inclusion: affordability (income from MSME is too low/irregular, bank charges are too high, insurance is too expensive), appropriateness (many MSMEs lack required formality and documentation such as address and financial records to open a bank account), and accessibility/proximity in rural areas (banks are too far away).

Other challenges include informality (not being registered/licensed), limited use of sophisticated marketing strategies, and the fact that many businesses are necessity driven (rather than opportunistic) which affects growth and sustainability of the businesses.

A study by FinScope shows that about $7,4 billion is circulating in the informal sector.

Interestingly, the majority of the MSMEs do not pay tax. Generally there was a lack of understanding of the tax system, on how it works, and a lack of faith in the system since they could not see any tangible benefits.

A study done by Probe Marketing shows that MSMEs are of the view that there is injustice on the tax rates as they are too high and they felt that there was multiple taxation going on.

The Zimbabwe National Competitiveness Report (2015) shows that Zimbabwe’s informal sector employs about 84 percent of the total labour force with the majority of the workers employed in the agricultural sector.

The report shows that productivity is very low in agricultural sector that is, averaging around $420 per labour. The ties in with the observations by the FinScope study which alluded that incomes from formal employment tend to be low and hence secondary incomes are essential.

Incomes from entrepreneurial activities provide an important opportunity to ‘top-up’ incomes, and they are often based on activities that can be fitted around a main job.

A quarter of MSME owners reported to generate additional income from another job / business. As such, owners of “top-up” businesses might not see the need to register their entrepreneurial activities.

Reasons for resistance to formalise

Probe marketing study shows that Zimbabwe’s informal sector view the formalisation processes and requirements of registration as complex and expensive.

This is a particular issue where educational levels are low and entrepreneurs have to engage help in completing the paperwork required (29 percent of MSME owners have primary education or less).

Owners of survivalist businesses might not see the need for registering their business activities as the associated cost registration and compliance might exceed the limited income. Based on FinScope study, about 35 percent of MSME owners reported that they do not have the money to register their business activities, 26 percent don’t know how to register, and 10percent reported that it is too complicated.

Further, there are low levels of awareness as to what the benefits of registration are.

To be continued

Dr Mugano is an Economic Advisor, Trade and Competitiveness Expert, Research Associate at Nelson Mandela Metropolitan University (SA) and Visiting Lecturer at the University of Zimbabwe’s Graduate School of Management. Feedback: Email: [email protected], cell: +263 772 541 209.

Comments