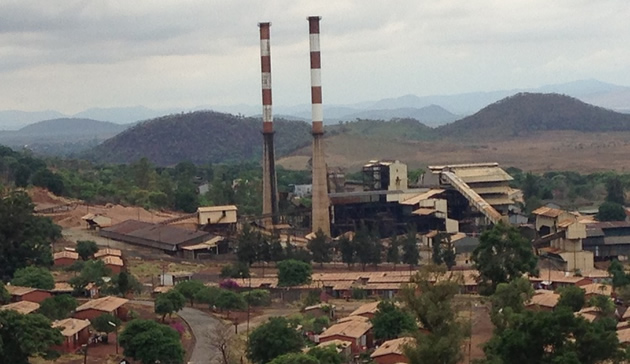

BNC set to restart Trojan Mine smelter

Business Reporters

Bindura Nickel Corporation has started discussions with different nickel producers to secure additional material to supplement production at Trojan Mine following a successful subscription to its $20 million bond issue for the smelter restart.

BNC, which is a subsidiary of Mwana Africa Plc, last year floated a $20 million bond issue in order to raise funds for the restart of its Trojan Mine smelter.

Mwana Africa chief executive Mr Kalaa Mpinga told a Press conference yesterday that the company’s $20 million bond issue has been fully subscribed and the smelter restart was now inevitable.

“We would like to announce that the Bindura Nickel Corporation $20 million, five-year bond issue which closed on Friday 27 February this year was fully subscribed.

“As has been previously advised, the proceeds of the bond will form the major part of the $26,5 million needed to finance the smelter restart project,” said Mr Mpinga.

“We have also started discussions with nickel producers to secure additional material to supplement production of Trojan Mine. There are companies who have expressed interest from as far as Australia.”

Mr Mpinga said work on the smelter is expected to take nine months to complete and on commissioning it is anticipated that the smelter will have capacity to process 160 000 tonnes of matte per annum.

The smelter restart project commenced at the beginning of the year and most of the technical work is progressing well with various equipment components at different stages of completion.

With the closure of the bond, the project will now be accelerated and the company expects to fire the smelter within the next nine months.

Numerous benefits will accrue to BNC and the country as a result of the smelter restart, with the major ones being increased revenue per tonne by between 15 percent and 20 percent due to the production and export of a 70 percent nickel leach alloy as opposed to the current scenario of concentrate exports and improves profitability as a result of a number of cost savings.

The smelter restart will create a minimum of 300 direct jobs and other indirect jobs through outside contractors and service providers.

Mr Mpinga said the smelter goes a long way in ensuring that BNC is operating in line with Government’s soon to be compulsory mineral beneficiation and value addition policy.

“It is the second step in a journey that will see BNC produce a nearly 10 percent beneficiated nickel cathode in the long term, when the refinery is restarted. The board’s strategy has been to regrow the business in phases.

“Phase one was restarting the Trojan Nickel Mine and we have managed to ramp up production from traditional tonnages of around 5 500 tonnes of nickel and we have now stabilised at 7 000-7 200 tonnes of nickel per annum, which is a massive jump,” said Mr Mpinga.

He said the bond issue would not have been a success without the support of Ecobank Zimbabwe who were the lead under- writers.

Ecobank Zimbabwe managing director Mr Daniel Sackey said the bank’s role as lead underwriter of the bond issue confirms Ecobank willingness to support projects that have the potential of contributing to Zimbabwe’s economic growth.

“Ecobank is delighted to be part of this transaction, which not only supports BNC in its quest for revenue growth and to significantly boost Zimbabwe’s capacity to promote value addition in the mining sector,” he said.

Comments