Bindura Nickel’s concentrate output up 5pc

Business Reporter

Business Reporter

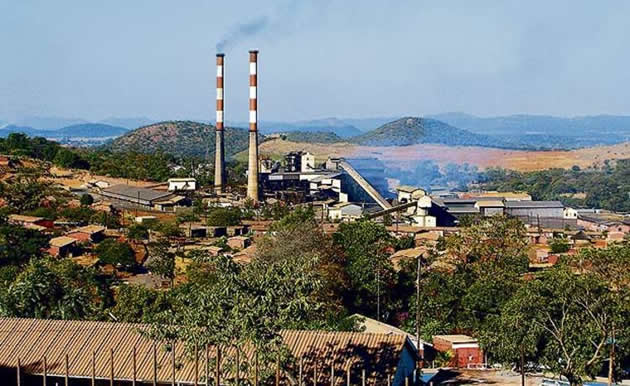

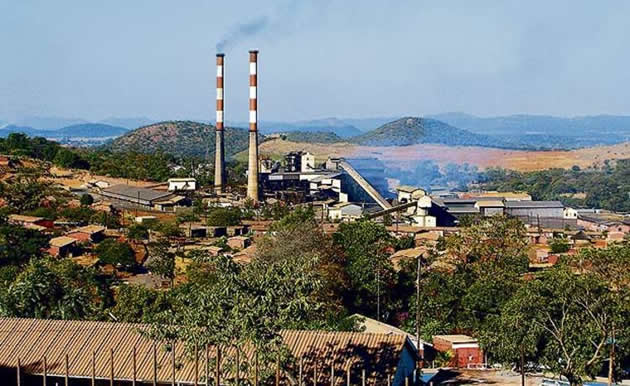

Bindura Nickel’s in-concentrate production for the second quarter to September 30 this year increased by 5 percent to 1,989 tonnes after the company completed its equipment refurbishment exercise.

The increase in production was also due to a 3 percent increase in the tonnes mined to 160,741 tonnes from 155,610 tonnes from the previous quarter.

Head grade was 2 percent lower at 1,496 percent (Q1 2015 1,519 percent) due to the temporary mining of lower grade massive ores in accordance with BNC’s mine plan.

Recoveries were down 2 percent to 82,5 percent (Q1 2015 84,1 percent). Nickel sales were 7 percent higher at 2,008 tonnes (Q1 2015 1,871 tonnes).

Cash costs increased by 1 percent to $13,900 per tonne (Q1 2015, $13,750 per tonne) and all-in sustaining costs decreased by 1 percent to $14,566 per tonne (Q1 2015 $14,776 per tonne).

“The operation’s return to profitability has allowed us to reverse previous provisions for deferred tax of $4 million for the 6 months to September, carried in the accounts as an asset.

“The reversal is an accounting adjustment with no cash flow impact, said Mwana Africa in a statement.

Five percent increase in average nickel price received to $18,592 per tonne (Q1 2015 $17,745 per tonne).

Mwana said post the approval to restart the smelter, preparatory work is progressing well with the core project team in place.

The company said key equipment orders and contracts have been made including for the control and instrumentation, the furnace off gas system, converters, the precipitator overhaul, furnace and converter bricks, transformer inspection, cleaning and testing, cooling system coolers, engineering design and project support and converter repairs.

The submission to the Environmental Management Agency will be made during this month and financing discussions are advancing in relation to the smelter.

Freda Rebecca’s gold production rose by 23 percent to 16,555 ounces, against 13,503 ounces in the previous quarter as a result of improvements in feed grade, recovery and milled tonnes.

Tonnes milled rose by 21,3 percent to 319,768 tonnes (Q1 2015 263,531 tonnes) and the average feed grade was 9 percent higher at 2,25 grammes per tonne (2,07 grammes per tonne in Q1 2015)

Mwana said feed grade for Freda improved as the main production stopes were fully available and intersected expected grades.

Gold recovery for the quarter was 4,2 percent higher at 80 percent compared to 76,8 percent in first quarter of 2015.

Cash costs for the quarter under review fell 18 percent to $880 per ounce from $1,078 per ounce in Q1 2015, whilst all-in sustaining costs decreased by 17 percent from $1,283 per ounce in Q1 2015 to $1,061 per ounce in Q2 2015 demonstrating the mines capability to remain profitable in a lower gold price environment. The average gold price received during the period was 2 percent lower at $1,272 per ounce, (Q1 2015 $1,296 per ounce).

“We have continued to invest in making our operations more stable and are now demonstrating the positive impact of that investment. Arguably, the most important decision has been to begin the process of restarting the Bindura smelter at a cost of $26.5 million,” said Mwana Africa chief executive Mr Kalaa Mpinga.

He said the smelter at Trojan is set to be restarted in the first half of 2015 and will produce nickel leach alloy.

Mr Mpinga said at Trojan they will continue to ramp up to steady state production, the tonnage mined increased as a result of the refurbishment programme which is expected to be completed in December 2015. He said at Freda gold production increased quarter on quarter with higher grades of ore drawn from underground and the mill throughput being augmented by the processing of surface material.

“The modifications implemented in the previous quarters appear to be bearing fruit and we look forward to maintaining a more consistent operating performance in the coming quarters,” said Mr Mpinga.

Comments