Africa must learn from Europe’s structural failures

James Schneider Correspondent

James Schneider Correspondent

THE euro’s internal contradictions have sent Greece into a depression, contributed to a near continent-wide stagnation, and threaten to derail an entire political project. Africa, which may see new regional currencies emerge in the next decade, should stop modelling economic integration on Europe’s former successes but rather learn from its structural failures, argues James Schneider.

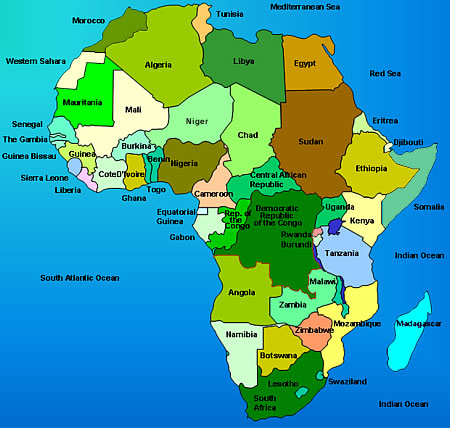

Ten years from now, a Burundian trader may borrow money in Rwanda, buy goods in Kenya and sell them in Uganda, all using the same currency — the East African shilling. Little can symbolise economic integration — and the hoped-for economies of scale it brings — like a shared currency. But the world’s biggest single currency, the euro, which brings together 19 nations, is a poor advert for monetary union. Greece has recently been pushed to the brink of exit and instead had to accept an agreement with its creditors that will likely cause a depression. The euro has been the model for Africa’s planned but not yet delivered regional currencies. European policymakers’ spectacular failure to manage their single currency, does not mean that Africa should abandon its plans. But, the economic model and rules employed by the Eurozone should be rejected. Europe has piloted a currency union based on one-sided competition and internal race to the bottom. Africa could introduce single currencies based on solidarity.

Before countries join the euro — and once they are members — they must comply with five convergence criteria. These rules are meant to bring members’ macroeconomic outlooks in line with each other. For the euro, these criteria covered: the rate of inflation, size of the government deficit, the debt to GDP ratio, exchange rate stability, and long-term interest rates. As long as countries met these rules — or could be made to appear to do so by dodgy accounting, as was Greece’s case, aided by investment bank Goldman Sachs — they can join. In theory, if they stay within these bounds, nothing can go wrong. This assessment has been proved woefully inaccurate. Proposed monetary unions in Africa worryingly follow the same theoretical framework as the euro. The East African shilling (the East African Community’s (EAC) proposed currency) and the eco (the Economic Community of West African States’ (Ecowas) proposed currency) follow this path, with a few modifications. The eco, for example, includes some additional convergence criteria such as a minimum tax revenue to GDP ratio, maximum wage expenditure in government budgets, and minimum levels of public investment. These are good additions. However, they fail to tackle the roots of the Eurozone’s failure: locking in unfair advantages for some countries, allowing internal devaluation by proxy, and emphasising competition over cooperation between members.

Competition, not cooperation

The eurozone’s framework emerged out of a particular set of circumstances. In the 1970s, much of Western Europe suffered from stagflation — economic stagnation coupled with inflation. After the almost thirty years of post World War Two boom, Europe was stuck. Germany was the outlier with inflation running at around 5 percent as opposed to around 10 percent for France and nearer 25 percent for the UK.

Policymakers set about designing systems that would make other countries more like Germany. Many European countries linked their currencies to the German deutschmark to “import” low German inflation. The path to the euro was set and with it Germany’s role as anchor country enshrined.

Germany’s position of anchor country has conferred significant norm-setting advantages — the European Central Bank (ECB) is modeled after Germany’s Bundesbank, for example — but also prevented critical analysis of the effect of Germany’s policies on other nations. Germany was the model nation against whom others measured their policies. This helped build up dangerous imbalances.

The euro assisted Germany in profoundly shifting its economic model. From the end of World War Two until the 1990s, Germany had an economic model based on strong domestic demand and high wages that rose in line with productivity gains. By the 1990s, the heyday of neoclassical economic theory, wages that rose when workers produced more was seen as the cause of Germany’s then-high unemployment. German government, businesses and unions agreed to keep wage increases down, hoping to boost employment. Germany’s entry into the euro allowed the theory that relatively low wages will increase employment to appear accurate. Rather than German unemployment reductions being tempered by the reduced domestic demand in the economy caused by relatively lower wages, Germany was able to grow massively its export base and reduce unemployment. Exports as a share of German GDP rose from below 25 percent in 1995 to over 50 percent today.

Falling German unemployment and increased export competitiveness seems like success. European policy makers look to Germany and suggest that all should follow this path. Unfortunately, it is not a path that all can follow because it is partly parasitic on the rest of the Eurozone. Many of the jobs that flowed into the German economy were ones that left other EU countries. As the German export sector grew, the industrial sectors in France, Italy, and Spain declined. While consumption in the deficit countries of southern Europe was able to increase in the euro’s pre-crisis years, development of a sustainable industrial base could not.

While genuine technological and process advances assisted Germany — and these should be applauded — three structural elements helped German growth to the detriment of other Eurozone countries.

The euro was created out of a number of currencies. Those countries which had above averagely strong national currencies traded their currencies in for a relatively weaker one. This provided a boost to German exports as German goods became cheaper for foreigners. As demand for German exports increased over the opening decade of the Euro, the German currency — now the euro — didn’t appreciate. In effect, the euro subsidised German exports. The inverse is true for deficit countries like Greece, which would have had a weaker currency if it were not in the euro, which would have boosted its exports and made imports more expensive, possibly assisting domestic industries.

Germany and other surplus countries were able to recycle their surpluses in other EU nations. Lending to Greek, Spanish and other southern banks was made easy, while the risks of lending to southern governments was under-priced. Leading German industrial companies developed their own huge finance arms, lending southern consumers money to buy their goods. The easy credit and relative cheapness of German goods in deficit countries undermined those countries’ domestic industries. Why buy a Greek product when you can buy an artificially cheap German one on credit at a low rate of interest?

Most significantly, Germany year-on-year devalued relative to other European nations by having lower inflation, due to wage suppression. German inflation was consistently below the 2 percent Eurozone target. This meant that, according to European Commission data, after the euro’s first decade, Germany opened up a price gap with France of 15 percent and 25 percent with southern Europe. In other words, Germany pursued a policy of lower than average inflation, which made its goods relatively cheaper.

As such, the euro, for all its other benefits, exacerbated the relative competitiveness and uncompetitiveness of European economies, trapping them in an unsustainable cycle.

James Schneider is Senior Correspondent at New African magazine and was formerly the Editor-in-chief of Think Africa Press. This article is reproduced from New African magazine.

No selling out

Despite the euro’s failures, all is not lost for single currencies. Monetary union rules are not set in stone. Africa can build single currencies based on cooperation, rather than beggar-thy-neighbour competition. This will produce more competitive economic blocs as a whole.

To build successful African currencies, one economic statement has to be agreed upon and one political perspective has to be adopted.

It must be recognised that systems must balance — if there is a surplus somewhere, there is a deficit elsewhere. To solve the deficit, you must also look at the surplus. Not all countries can mathematically be in surplus, so policies must be derived to not punish those that are not but rather reduce imbalances. Successful national policy should be measured in proximity to the beneficial position for all members of the union, rather than beating the average. Germany’s below average inflation has caused just as many problems as another country’s rather high inflation might.

To put this economic understanding into practice, countries need to practice solidarity.

It is important that the principle of solidarity and rules assisting it are put in place in African single currencies now, even though the types of imbalances seen in Europe won’t occur in Africa for some time.

These solidaristic African single currencies could develop in four stages. First, the convergence criteria as broadly set out, especially the eco’s additional criteria, should be implemented but in the knowledge that falling significantly below targets is to be guarded against as well as overshooting.

The second stage, which should happen concurrently with the first, is for all members to come to common rules about some taxes. These need not be overly restrictive and prevent different economic models but designed to prevent one country gaining an unfair advantage at the expense of another. Policy and economic competition should have the goal of creating sustainable improvements for all, with the early adopters getting a first movers advantage boost. Members need to have a general anti-tax haven rule, so that one country’s legitimate tax returns can’t be squirrelled away elsewhere. They should also have a minimum standard for foreign investment rules and tax rates. Rwanda, for example, should not be taking business from Uganda at a significantly lower rate of tax that costs the EAC as a whole. Parameters should be set so that members compete with each other in replicable ways — good infrastructure and productive workers, for example — rather than self-defeating races to the bottom on tax.

The third stage should be elements of a transfer union — some tax money from richer regions going to poorer ones. This becomes more important as industry develops in parts of the union. It will involve, for example, Kenyan money building infrastructure in, and Rwandan skills and technology to be shared with, Burundi.

The fourth stage is the most innovative. It is what Europe needs to do to save the eurozone. African monetary unions have time to develop these processes as inflation has a different make up in African economies to European ones.

In Europe, wage levels are the main determinant of inflation. In Africa, printing too much money, exchange rate instability, and commodity prices are still the major determinants of inflation. A monetary union should massively reduce the risk of printing too much money, reduce exchange rate instability, and bundle the commodities produced by member countries, reducing the overall exposure to one commodity’s world market price. Then, as labour becomes a more significant part of the macroeconomic outlook and industrialisation takes place, managing relative wage levels between countries will become more important.

To prevent the situation where Germany holds down wages in a way that gives an unfair advantage against other member countries for whom it would not be beneficial to pursue the same policy — such as Greece, which has a high domestic demand relative to exports — some collective management of wages is required. To do this, wages in each country should rise in line with a rolling five-year average of productivity increases. This means that if Ghana, for example, increases labour productivity, Ghanaian workers see the benefit, rather than this being used to undermine Ivorian industry. In this way, workers in the more competitive countries benefit and the less competitive countries are made more competitive by their lower relative wages.

Getting rich together

Monetary unions don’t need all their member nations to be as rich as each other. Differences can be managed. They just must all become more prosperous together. One country or group of countries getting rich at the expense of others can undermine the whole system.

This requires a degree of political pan-Africanism to be coupled with the significant levels of economic pan-Africanism. National sovereignty and different economic and social models can remain. But, this sovereignty and policy independence can’t be used to undermine other member nation’s economies. In the same way that inter-state relations are governed by rules — like, don’t invade your neighbours — monetary unions require rules that prevent one country’s policies adversely affecting another’s and therefore the union as a whole.

Monetary unions are difficult things but Africa can lead the way in developing sustainable and prosperity generating ones. Africa has the language, pan-Africanism, within which to frame the necessary economic reciprocity and political solidarity. The continent is all too aware of the deleterious effects of structural economic domination and the inhuman economics of structural adjustment, which is written into the heart of the Eurozone’s narrow rules.

Africa’s proposed single currencies are currently modelled on the euro. If this does not change, they may fail. If it does, Europe will have a lot to learn from Africa.

James Schneider is Senior Correspondent at New African magazine and was formerly the Editor-in-chief of Think Africa Press. This article is reproduced from New African magazine.

Comments