25pc salary cut for NSSA bigwigs

Felex Share: Senior Reporter

The National Social Security Authority (NSSA) has slashed salaries of top management by more than 25 percent and scrapped other perquisites that were gobbling millions of dollars of workers’ monthly pension contributions.

The new framework took effect on April 1.

This follows massive corruption and maladministration by the previous management that saw some top managers earning more than $40 000 every month.

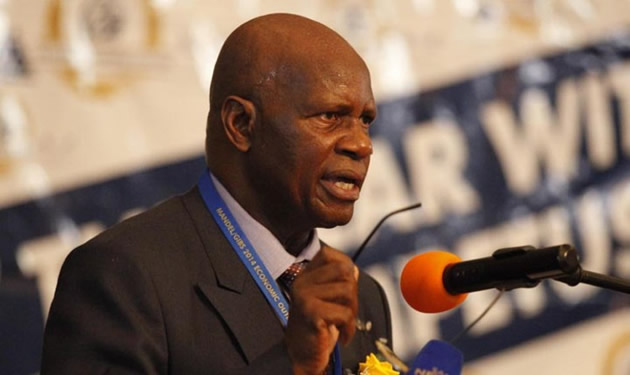

The top management, led by former general manager Mr James Matiza, also pampered their lovers with dubious loans using the authority’s funds.

Mr Matiza has since been retrenched together with four other directors — Messrs Shadreck Vera (investments), Patrick Mapani (finance), Tendai Mafunda (corporate services) and Bright Chidyagwai (ICT).

TOPICS: CORRUPTION

- 4 anti-corruption bosses suspended

- System protects criminals: Chihuri

- Join hands to fight graft: Mnangagwa

- Of thieving school heads, corrupt SDCs

NSSA acting general manager Mr Hashmon Matemera yesterday confirmed that with the guidance of the board led by Mr Robin Vela, the authority had agreed to cut the salaries of top management as well as reduce a litany of benefits the managers were getting.

The benefits, he said, included holiday, education and child school fees, among others.

He said NSSA was moving towards a “cost to company” model of employment in line with modern global trends.

“We have implemented this beginning April 1 and we got sign off from all the relevant worker representative bodies in the authority,” he said.

“It entails remunerating employees on a total cost to company and the impact has been a total reduction in our wage bill by more than 25 percent. There has also been a reduction in the number and amount of some benefits.”

It is understood the company car scheme has also been replaced with an individual vehicle ownership scheme.

Mr Matemera said the five retrenched managers went home empty-handed as their benefits and pensions compensated for what they looted.

They had also returned assets and cars belonging to the authority.

Said Mr Matemera: “Four of the directors returned the cars and one opted to buy his car at the agreed price.”

Public Service, Labour and Social Services Minister Prisca Mupfumira said the new framework was in line with the prevailing economic environment, which was equitable and fair to both the authority and staff.

She said the model was aimed at striking a balance between what NSSA was paying its staff against payments to pensions.

“They have also reduced the employer pension contribution from 18 percent of basic salary to 7,5 percent in line with other Governmental department caps,” she said.

The previous NSSA management had often been vilified for their choice of investments, including concentration in the equities market and financial institutions where it recently lost about $20 million after dabbling in the affairs of cash- strapped Capital Bank.

NSSA spent $100 million on investments that included shareholdings in broke companies and properties with inflated prices.

About $2,5 million went into the now defunct CFX Bank, while $12 million was splashed on overpriced starafricacorporation shares and $1,5 million on Africom Continental.

At least $45 million is locked in Interfin Bank, which is now under curatorship after being fingered in the alleged abuse of depositors’ funds.

The bank had non-performing insider loans worth $60 mil- lion.

In addition, NSSA lost $11,2 million worth of property to local authorities for non-development.

The institution also dished out “non-profitable” loans to parastatals, with the National Oil Company of Zimbabwe getting $3,1 million and Zesa $9 million.

Cottco got $5 million in November 2009 and another $3 million in April 2010 at a 124-day tenor and interest rate of 18 percent per annum.

The Grain Marketing Board received $5 million for a flat 2 percent facility fee and 4 percent per annum on a 90-day tenor.

These questionable investments were detailed in a forensic audit report compiled by the National Economic Conduct Inspec- torate.

Comments