2015 Budget: Banking sector confidence key

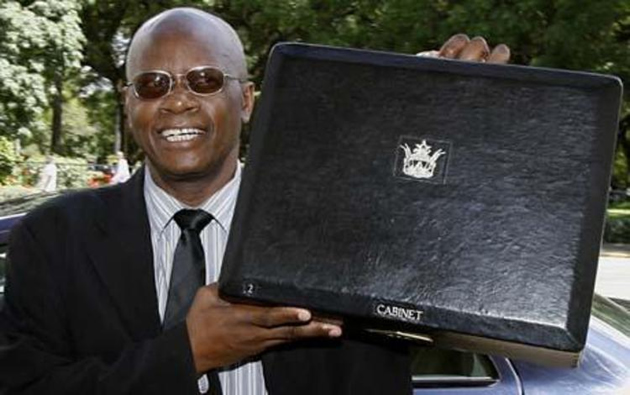

FLASHBACK. . . Then Acting Finance Minister Chinamasa poses for a photo before presenting the 2009 National Budget

Business Editor—

Restoration of confidence in the banking sector should be one of the key focus areas of the 2014-15 National Budget if the country is to set itself on an economic growth trajectory. Analysts who spoke to The Herald Business yesterday called on Finance and Economic Development Minister Patrick Chinamasa to effectively deal with the problems surrounding the banking sector in order to inspire confidence in the economy.

Some of the issues which were highlighted as critical to the success of the 2014-15 National Budget include the finalisation of the recapitalisation of the Reserve Bank of Zimbabwe, the re-establishing of the lender of last resort function and the completion of the demonetisation of the Zimbabwe dollar so as to boost depositors’ confidence.

Markets analyst Mr Jerome Negonde said depositors have over the years been battered; first by the collapse of the local currency which eroded all pensions and savings and, secondly, by the collapse of certain banking institutions over governance issues.

“With that in mind Government needs to bring finality to the issue of the Zimbabwe dollar balances while at the same time setting up a Fiscal Court to deal with any issues that may arise from within the banking sector,” said Mr Negonde.

Economist Joseph Sagwati, who has experience in the banking sector, said it would be a rewarding experience for the sector to be considered for a direct allocation through the Budget via some quantitative easing of some sort.

“This obviously is taking hope into the utopian realm since the current Government through the Reserve Bank is hamstrung from performing the function through loss of monopoly over print machine. Be that as it may the banking sector can benefit from tax concessions and other imposts that the authorities have been subjecting them.

“There is need for a liberalised trading environment with give and take concessions on say banks that are supporting housing and infrastructure to be granted tax concessions,” said Mr Sagwati.

Government was also urged to rein in on its borrowings (at the moment skewed towards domestic) with the Budget called on to ensure borrowed funds are directed towards the productive sector so as to improve investments and liquidity in the economy.

This was after RBZ, which reports the total stock of Treasury Bills for |Government (including part payment of outstanding obligations), said the amount stood at $305,34 million in the September period.

Last year, according to the RBZ annual report, Government closed the year with $241,32 million outstanding domestic debt instruments.

Analysts say that while it looks like Government is repaying its debt without hiccups the reality is that they are simply rolling over – issuing new TBs to pay off old ones. The amount of TBs outstanding is increasing even further with the payment of the 13th cheque.

“If Old Mutual and NSSA fail to take them up on private placements, Government might find it difficult to repay the old maturing ones. Is it not possible that some of the funding is coming through by way of deposits for projects?” said an analyst with a local firm.

There are suggestions for Government to open the bills to foreign investors who may want to expose themselves to Government risk while there are calls to make the bills tradable and offer a good yield to maturity.

“It will be a lot better if the TB system uses the old tender system instead of the current private placement as the tender system gives market direction on interest rates,” said Miss Fiona Chigwida, an analyst with a local firm.

Analysts also called for the reduction of withholding tax on investments from 15 percent to 5 percent in order to encourage savings while also reducing taxes on low-income earning individuals in order to stimulate savings so as to deepen the role of the financial sector.

“Overall, an indirect benefit to banking would be the widening of tax-free thresholds for persons and corporates allowing more disposable income into individuals’ pockets some of which will surely find its way into savings,” said Mr Sagwati.

Comments