2014 Budget: It’s all about execution

Happiness Zengeni Business Editor—

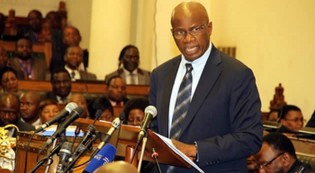

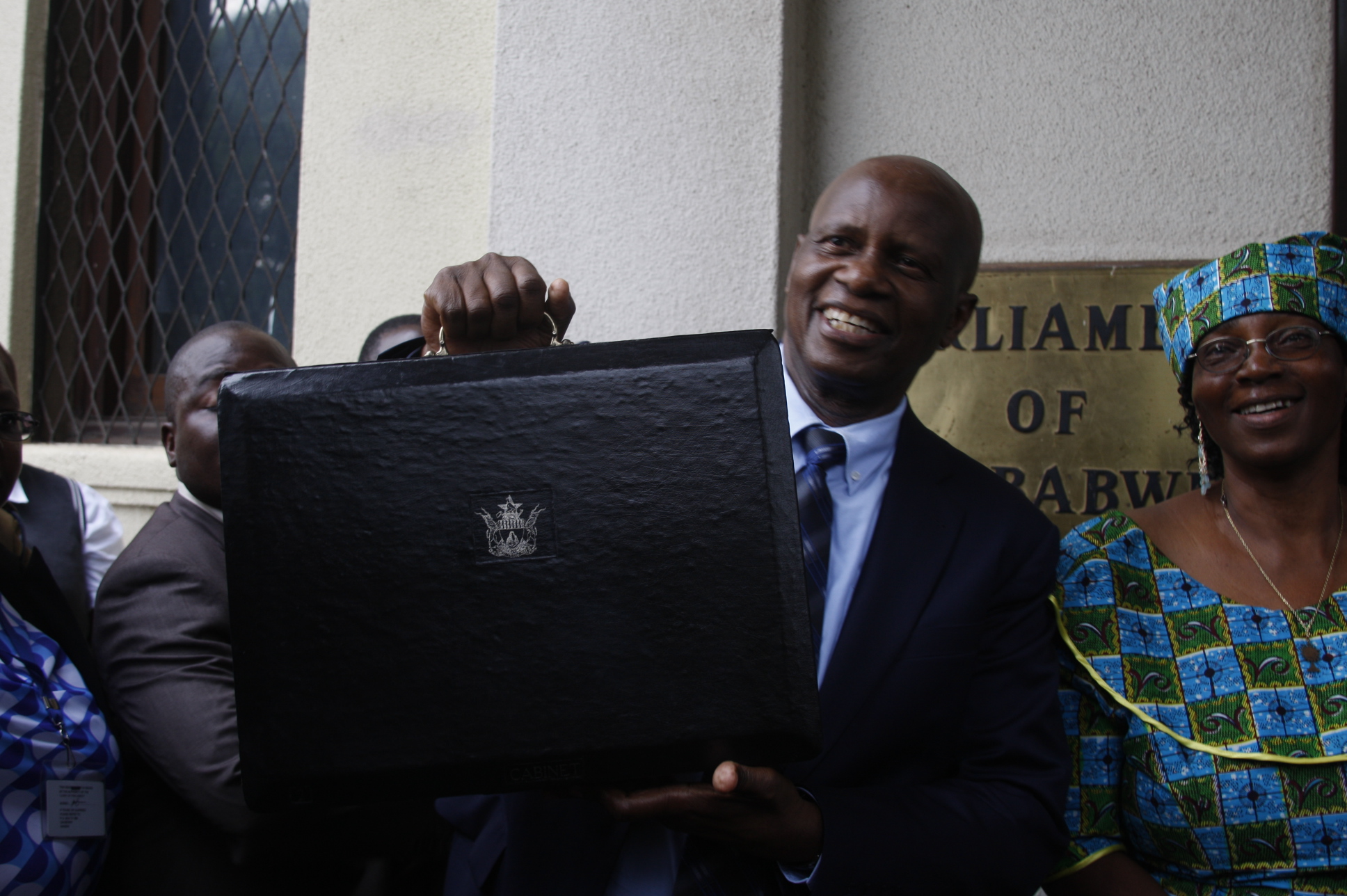

IF properly executed, the 2014 National Budget presented by Finance Minister Patrick Chinamasa on Thursday, will successfully address the economic circumstances of the country in the long run. Minister Chinamasa on Thursday presented a US$4,1 billion Budget which projected growth in the economy of 6,1 percent next year, underpinned by agriculture and mining production.

He admitted the environment was depressed and said it was because of this that he was going to centre his proposal on policies, which would unlock value for the economy.

The minister had little room to manoeuvre given the economic environment, which is characterised by low aggregate demand, high consumer and company debt, a thinning tax base and a weak financial system.

In the Budget proposal, Minister Chinamasa said policy consistency, credibility, certainty and transparency were critical blocks in building confidence in the economy.

Budgets translate a Government’s policies, political commitments and goals into decisions on how much revenue to raise, how it plans to raise it, and how to use these funds to meet the country’s competing needs.

A Budget system that functions well is crucial to developing sustainable fiscal policies and economic growth.

Brainworks Capital’s Mr George Manyere, who is also an investment banker, said the budget was policy driven and consistent with the economic blueprint, the Zimbabwe Agenda for Sustainable Socio-Economic Transformation (Zim-Asset).

“It is no doubt sustainable; you need something like that to kick start recovery. All that’s needed is strong execution and implementation.”

He added that once Government gets these two right, the country will be on a strong positive economic development trajectory.

Mr Manyere said foreign investment will come if the country adopted the right instruments to attract capital to fund the budget.

Analysts say the budget sets the pace for creation of flexible investment policies and adoption of export-oriented growth strategies, which not only focus on mineral or tobacco exports; but also on manufacturing to a point where there is an almost even split to the export trade contribution figures.

In a post-budget meeting hosted by the Confederation of Zimbabwe Industries in Harare yesterday, captains of industry concurred that the enabling environment that the budget sought to create was most welcome.

Reserve Bank of Zimbabwe Acting Governor Dr Charity Dhliwayo said the budget statement breathed life into the central bank as Government proposed several measures to make it regain its lender of last resort status.

Government recently took over RBZ’s US$1,35 billion debt, before Minister Chinamasa’s proposal to re-capitalise the bank to the tune of US$150 million to US$200 million, backed by a loan guarantee by Afreximbank.

“We thank Government for giving us a new lease of life where debt has been removed meaning we can play our central bank role without restrictions.

“We are now able to fully complement government efforts in ensuring the success of the Zim-Asset, and the statement has also given us direction in as far as policy is concerned.

“As we now start consultations for the Monetary Policy Statement due for release soon, we call upon all stakeholders to make submissions so that the policy can be able to gel in well with Government budget/policy statements in as much as it will also be stakeholder driven,” she said.

CBZ Holdings chairman Mr Luxon Zembe said the budget focused on policy clarity on key issues such as Zimbabwe dollar, banking sector stability and capitalisation of the Reserve Bank.

“The statement is a welcome one. For example the de-monetisation of the Zimbabwe dollar has brought to an end speculation on its imminent return and that is now a closed chapter,” Mr Zembe said.

He added that he was optimistic Government, and Cabinet in particular, would continue to sing from the same hymn sheet in order to avoid policy disharmony in as far as implementation and interpretation of the spelt out measures was concerned.

Mr Zembe, however, said he felt more justice could have been done to two critical areas; namely, addressing high unemployment and attracting foreign direct investment (FDI).

He said contrary to statistics recently released by the Zimbabwe National Statistics Agency that unemployment stands at 11 percent, the figure was higher.

On the issue of FDI, Mr Zembe said it was critical to engage with international partners so that the country could attract investment while also forming partnerships to fund infrastructure rehabilitation programmes.

Zimbabwe National Chamber of Commerce and Industry deputy president, Mr Davison Norupiri, said Government’s move to impose heavy import duties on some products should be dealt with cautiously in order to achieve the intended results of discouraging the importation of goods that would be locally available.

“The issue of porous border points should be dealt with first to ensure smugglers are thwarted, so a lot has to be invested in beefing up our border security systems.”

Zimtrade chief executive Ms Sithembile Pilime was of the view that while increasing import tariffs was welcome, it would not achieve much in isolation of measures that ensure an increase in local production.

She emphasised the need for consistent power and water supplies to ensure production costs were reduced to sustainable levels.

Bankers Association of Zimbabwe president Mr George Guvamatanga said financial services sector policy measures in the budget were well-articulated, but his main worry was that the country’s cost of doing business model was wrong.

“The statement is clear on matters regarding policy, but the main cause for concern is that as a country our cost of doing business structure is very wrong.

“Wage and salary structures and not in sync with productivity on the ground, this therefore translates to a wage bill that consumes more than half of the budget, so a new business model that addresses this issue is critical if we are to have an effective budget that serves its purpose is in place,” he said.

He, however, said it was well spelt out as to how small and medium enterprises and agriculture were critical.

Mr Guvamatanga added that the banking public should not panic after memoranda of understanding (MoUs) with the central bank were cancelled.

“There is a general consensus that cancellation of the MoUs would result in banks hiking their service charges, but what I want to say is that competition no longer allows for the unwarranted increase in charges otherwise you will simply get yourself out of business.

“To date I am not aware of any of our members who intend to effect an increase in charges,” he said.

Zimplats chief executive Mr Alex Mhembere also commended Government for its emphasis on value addition and beneficiation of minerals, since this obviously increased revenue streams to the State.

“This is coming at a time most metal prices are heading southwards and we obviously need to look at the impact and see whether the margins enable the miners to stimulate production under these circumstances.

“However, we support the notion of value addition in order to increase the revenue flows to the country in line with the budget statement,” he said.

Comments